Cryptocurrencies like Bitcoin and Ethereum exploded into the mainstream in 2017, creating over 100,000 new millionaires and causing many to wonder if they need to invest in “crypto” — either for normal financial returns or specifically for prepping.

Many people in the technology community think crypto and blockchain (the underlying technology that powers cryptocurrencies) could be as big of a fundamental and transformative innovation as the internet or mobile phones. That won’t happen quickly and could very well be overhyped. But it does represent a meaningful jump forward that can change much of how the world operates.

For now, putting money into cryptocurrency is a speculative gamble, not an investment. It’s the difference between buying a house to rent out for passive income versus heading to Vegas.

Bitcoin and other cryptocurrencies can be a small part of a prepper’s portfolio, similar to precious metals like gold and silver. It’s a diversified insurance policy against economic and political risks.

Summary:

- Below, we explain what Bitcoin, cryptocurrencies, and the blockchain are in plain English.

- In short, think of cryptocurrencies as the internet’s money, similar to how the US has the dollar. It’s entirely digital, programmable money — opening up all kinds of new potential uses and technology, similar to how the internet changed everything.

- Do not blindly put money into cryptocurrencies because your neighbor’s grandson or Uber driver said it’s a good way to get rich.

- Do make an effort to understand what’s special about this technology, then invest if you believe in it.

- Things are still early and fluctuating wildly. The market is irrational and driven by emotion and potential. The fundamentals are not solid yet. This is somewhere in between an investment and a gamble.

- Up to 5% of your portfolio is a reasonable target — but only if you’ve already covered your financial basics, like a six-month liquid safety cushion and paying down high-interest debt.

- You can’t “do” much of anything with cryptocurrency… yet.

- Cryptocurrencies have value for the same reason paper money does: Everyone agrees it has value, and they trade it back and forth.

- That concept, called “store of value”, makes crypto more like gold and silver than owning stock in a profitable company (for now).

- Crypto relies on computers and the internet. If there’s a global SHTF grid-down situation, your crypto is worthless.

- But crypto still has a solid place in a prepper’s portfolio, because there are plenty of disasters where there’s still electricity and the internet, but for some reason you benefit by holding currency other than your local state-controlled one. For example, America‘s balance sheet might finally explode, causing the dollar to rapidly lose value.

Be prepared. Don’t be a victim.

Want more great content and giveaways? Sign up for The Prepared’s free newsletter and get the best prepping content straight to your inbox. 1-2 emails a month, 0% spam.

Why you should trust us

I am a technology entrepreneur and engineer that has built and sold companies in Silicon Valley. I’ve been aware of cryptocurrency/blockchain since 2010 and started investing in 2012. A former business partner was one of the largest holders of Bitcoin in the world, many in my network have made multiple millions of dollars in the last years, and I’ve successfully traded the major market movements in the 2017-2018 and 2020-2021 bull periods. Disclosures: I own ETH, BTC, MATIC, LRC, and USDC.

Bottom line for most preppers

You shouldn’t invest in crypto until you’ve got your basic financial foundation in order. If you’ve got enough of a financial foundation where you have a retirement account or do some stock market investing, then you can look at putting some of your eggs in the crypto basket.

Investing in speculative things like crypto when you have piles of credit card debt or no rainy-day fund is just too much of a risky gamble, and doesn’t align with sane prepping principles.

If you’ve got enough of a financial foundation where you have a retirement account or do some stock market investing, then you can look at putting some of your eggs in the crypto basket.

We recommend people put up to 3-5% of their liquid net worth into a diversified mix of cryptocurrencies, namely Ethereum and Bitcoin, which are by far the two largest.

So instead of having all of your $100,000 in retirement/savings in the stock market, diversify $5,000 of that into a mix of cryptocurrencies.

If you’re older, perhaps over 60-65, it’s generally a good idea to invest in safer assets like bonds and stocks. You can still play with crypto, but lean towards a smaller percentage of your portfolio. Crypto’s real potential is in the long term, but it might be a bumpy road to get there, and you don’t want to paint yourself into a corner with fewer years to recover.

How to buy cryptocurrencies

We recommend using Coinbase to start your investing. Sign up through that link and get $10 for free!

Coinbase is the largest and safest US-based exchange, similar to E*Trade or Vanguard for stocks. You’ll have to go through normal Know Your Customer (KYC) verification steps, like providing a photo of a driver’s license — just like any other regulated financial institution — but in exchange you’ll get more safety than some of the anonymous crypto exchange platforms.

Your Coinbase account acts like a “wallet”, which is the digital pocketbook that holds your digital money.

Why preppers like cryptocurrencies

- No government or company controls it.

- Everything can be anonymous (if you want it to be).

- The tech is distributed across millions of highly-encrypted computers around the world, meaning there’s no single point of failure/control and it can’t be hacked/corrupted.

- The value/price of cryptocurrencies aren’t correlated with disasters or geopolitical events the way a local currency is.

- There could be emergency scenarios where cash is hard to get or use, but you can still pay for things with crypto.

- You can move money across borders instantly, without insane bank fees or government permission.

- As the technology matures, you can use money in new ways that fit well with emergency preparedness — for example, you can “program” your house title or bank account to automatically transfer to your children upon death.

Independent of any country, government, or company

Cryptocurrencies are the world’s first universal currency since gold.

Many preppers are attracted to the idea of a private, encrypted currency that is independent of any government or the Federal Reserve. There’s so much spiritual alignment between the cryptocurrency and prepper communities that many people joke crypto was “made for preppers.”

But governments aren’t happy about losing control over something as important as financial markets.

So although they can’t really do anything to shut it down or directly control crypto, any government can enact laws that technically apply to their people in an effort to indirectly control a market.

Essentially: “If you do that thing we don’t want you to do, and we find out about it, you’re in trouble.”

For example, China isn’t happy about rich people moving their wealth outside of the country, and has now banned crypto entirely. Some people choose to obey those laws. Many others don’t, and crypto has been a key way for people to circumvent their oppressive governments.

Many people do not report crypto profits on their tax returns. The IRS knows that means many people are committing tax fraud, and they’re starting to stomp their feet about it. Which makes it likely that Congress eventually passes a law that says crypto trades in the US can’t be anonymous and are reported to the SEC/IRS. Any time you liquidate crypto, you’re supposed to report that on your taxes. The IRS has made crypto transactions prominent on Form 1040 and has sent nasty letters to crypto traders who haven’t reported their transactions.

Note that Bitcoin, Ethereum, and most of the current cryptocurrencies are independent of any company or country. But some countries are already exploring how to use this technology to modernize their own money. So if you buy CanadaCoin in the future, then theoretically it would be at least partially controlled by the Canadian government.

Isn’t Bitcoin worthless in an emergency?

Crypto only works through computers and the internet. It won’t matter how much digital money you have when the grid goes down. A bucket of food will be worth more than a Bitcoin.

But that causes too many preppers to automatically handwave it away. There are plenty of emergency scenarios where crypto could be beneficial, and those situations are relatively more likely than total SHTF grid collapse.

Crypto can act as an insurance policy in a way that’s unique compared to other hedges like gold and food supplies. It’s a new and unique way to cover some of your bases.

For example, after the 2017 hurricane that decimated Puerto Rico, demand for cash became “extraordinarily high” because banks and ATMs were either destroyed or empty. But some people still had access to their phones. You might be able to buy goods through an instant transfer of Bitcoin instead.

Partly because of the pain felt from the hurricane, Puerto Rico has attracted so many blockchain enthusiasts that it’s become known as “Crypto Rico”. El Salvador made Bitcoin an official currency.

Consider the very possible scenario where the US economy rapidly declines as we enter a post-work automation world with 40% unemployment, growing income inequality, housing/consumer/student debt collapse, and government debt that spirals out of control as they attempt to put bandaids on cancer.

The dollar could suddenly lose half its value. The government could decide to automatically withdraw 20% from everyone’s bank account or prevent you from moving that money overseas. The Federal Reserve could print more money, causing even deeper drops in the dollar’s value. China and other countries stop lending to the US. Maybe war breaks out.

Having some of your assets in crypto is a smart way to diversify that risk. This is why some of the earliest adopters of Bitcoin were wealthy people in China and Russia. They saw it as a way to protect their money against those local economic and political risks.

Is crypto a fad?

The short answer is that cryptocurrencies and the underlying blockchain tech are likely here to stay — but we don’t know which currencies will be the winners until the industry figures out what you can actually “do” with these coins.

Remember when the huge new innovation called the internet caused the late 1990s “dotcom” stock market bubble?

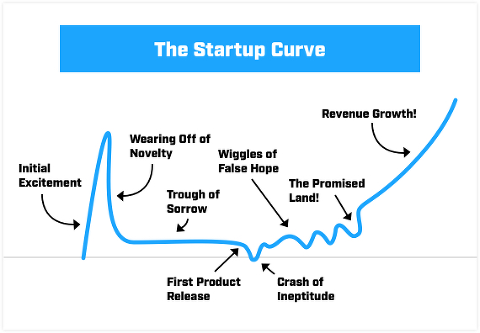

A transformative new thing comes along, like electricity or cars or the internet. People get really excited. The media promotes stories of people getting rich and how we’ll all have flying cars by the year 2000. It snowballs. People on the outside feel like there’s a cool inside joke they don’t understand, so they jump in without thinking about it. More snowballs.

This is a common pattern. Crypto and blockchain are going through it, too.

No one can predict the future. Maybe crypto is a fad and everything blows up. Maybe Bitcoin and Ethereum are like the first websites in the ‘90s, who fade away only to be replaced by the eventual winners like Google and Facebook.

But it is the educated opinion of relevant leaders that there’s something to this whole crypto/blockchain thing.

Obviously, the internet actually was a huge deal in 1999, with very valid long-term potential and wealth creation! But the emotions and speculation got a little ahead of reality, Fear Of Missing Out created a bubble, and things crashed. It took a few years of housecleaning to get back on the right track.

A single Bitcoin has gone from pennies to over $60,000 at times, with frequent and wild price swings as high as 20% in a single day.

You can’t actually do much with the actual currencies for now. You can’t buy things natively with Bitcoin in 99.9% of stores. The same is true for almost every other type of cryptocurrency.

Much (or most?) of the increase in value so far has been driven by speculators gambling that someone after them will pay more than they did. It’s a gamble that in the future the tech will mature and become more useful.

Like any new tech, it takes time to build things. Many innovative companies around the world and working on interesting projects that use crypto now that the foundation is figured out.

For example, some companies and local governments are moving their real estate title/deed records and property taxes to the blockchain. That will make the process of buying, selling, leveraging, and verifying real estate much easier and cheaper.

Cryptocurrency, Bitcoin, and blockchain 101

Bitcoin is a currency — a cryptographic currency, which means it’s digital and encrypted (cryptography). Think of Bitcoin like the US Dollar. It’s simply a store of value used for transactions.

There are many different cryptocurrencies, just like there are many different currencies around the world. Other popular cryptocurrencies include Ethereum and Chainlink. There are also cryptocurrencies that started as jokes that have become somewhat valuable, like Dogecoin and Shiba Inu.

These currencies run on top of a technology called the blockchain. Think of blockchains as a more modern, internet-native form of banks and the Visa credit card network. The pipes/network (blockchain/Visa) execute transactions (cryptocurrencies/dollars).

A simple way to think about it: Blockchain is the virtual bank that keeps track of and protects everything, and Bitcoin/cryptocurrencies are the money itself.

What is blockchain?

Let’s use the example of titles/deeds for a home. Today, we all trust one central database managed by the government to tell us who owns which piece of property, their tax values, GPS border coordinates, etc.

When you want to see if a person selling a house actually owns it and has the right to sell it, you check the local courthouse database. When you buy a house, the deed is updated in the local courthouse database.

That government database is the singular master record, and we trust our government to keep it accurate and safe. If some other random person said “I have my own list of who owns which property,” no one would take it seriously.

That system has worked really well over the last centuries, but it’s starting to break.

The fundamental innovation in cryptocurrency is that instead of having one central, master database, records are now decentralized, spread around the world in a limitless number of copies that are constantly syncing with each other.

Imagine if everyone that lived in your town had a constantly-updated digital copy of local property records. Even if the courthouse burned down or a disgruntled employee deleted everything on their local courthouse computer, nothing would be lost.

Think about how easy it has become to synchronize computer files. Most of us remember when you worked on a Word document on your home computer, then needed to email it to yourself or save a copy on a USB drive so you could continue on your office computer. Those files were constantly out of sync. Whenever a change was made to one local file, you had to manually copy and update the file on other computers to keep them synced.

Products like Google Drive, Dropbox, Mac iCloud, and Microsoft OneDrive eliminated that need. All of your phones and computers are constantly syncing the files so that if you update a Word document on one computer, the same file is updated on another computer.

Now the blockchain makes it possible to sync very large databases across a very large number of encrypted copies.

Not only that, but this network of copies can check each other for accuracy. So if one computer is hacked and records are changed, the rest of the network can tell something is wrong and reject those changes. This drastically reduces single points of failure and single points of control.

As a result, cryptocurrencies and the underlying blockchain technologies are considered very safe and “immutable”.

If you’re thinking “I trust the courthouse to have more accurate records than a database hosted by random people”, consider Wikipedia. People used to think “I trust Encyclopedia Britannica because it’s their sole professional job to write accurate articles. Why would I trust Wikipedia when any random person can write whatever they want?”

But it turns out that when you decentralize records and knowledge, it usually gets safer, faster, and more accurate. Anyone can put false info on Wikipedia, but the network of people reject that change. The “crowd” is better than a single person. The end result is that Wikipedia has been found to be more accurate and with fewer errors than the (now obsolete) professional encyclopedias.

Sticking with the property records example, each time a property tax value is changed, borders are altered, or ownership changes hands, that creates a new record in the history of that property. Over time, that creates a long list of records and updates/transactions.

In these modern distributed databases, when a new record update happens (like a new owner buying the house), that transaction is sent out to all of the computers in the network.

If other computers in the network determine that the new transaction is valid — it wasn’t hacked, each party is verified through their digital signature, each party had the right to buy/sell that property, the purchase contract was executed properly, payment was sent, and so on — then it accepts the transaction and updates the records.

The network bundles the most recently accepted updates together into “blocks”.

Those blocks are then synced to every computer in the network, adding that block as the most recent link in a long chain of transactions. Thus, a chain of blocks, or blockchain.

Once a block of records is added to the chain, it is forevermore part of that incorruptible history.

Programmable money

One of the very exciting things about blockchains and cryptocurrency is the creation of “programmable money,” also called a “smart contract.”

A $20 bill is just a dumb piece of paper. But imagine if you could program that money with instructions: “If Jerry Smith mows my lawn before July 4th, send $20 to his bank account.”

Or per-mile car insurance. Pretty soon, your driverless car will send wireless mileage logs to your insurance company, and your account will automatically be charged $0.01 for every mile you actually drive.

Emergency preparedness will get easier, too. Instead of worrying about how your two children will track down all of your financial accounts if you suddenly die, you can program your money to automatically split 50-50, send tax withholding to the IRS, then send whatever’s left to each of your kid’s accounts upon your death.

Common crypto lingo

Here are some other common crypto terms that you’ll encounter:

- Altcoin: A cryptocurrency other than Bitcoin like Chainlink, Dogecoin, or Ethereum. See also: Shitcoin.

- dApp: A Decentralized APPlication that runs on the blockchain instead of a central server or cloud.

- DAO: Short for Decentralized Autonomous Organization. Basically, a DAO is like a company or organization, but distributed over a blockchain. A DAO issues a unique coin and whoever owns the coins owns that much of the DAO.

- Gas: A fee paid to make Ethereum transactions as a way to prevent inflation. Gas fees can often greatly exceed the price of the transaction itself.

- Hodl: A deliberate misspelling of “hold.” To hodl means to hold on to your crypto and not sell it, especially during a downturn. “Hold on for dear life!”

- KYC: Know Your Customer. Mainstream crypto services must now take down your personal information like a copy of your driver’s license and Social Security Number so the government can see what you’re up to. People who like crypto for privacy try to find ways around KYC, like buying direct from individuals or through sketchy offshore markets.

- NFT: A non-fungible token. An NFT is a token, often based on Ethereum, that is not intended to be spent. NFTs are often tied to unique pieces of artwork and are traded as such.

- Stablecoin: A cryptocurrency designed to maintain a steady value, often pegged to the US dollar. Examples include DAI, Tether, and USD Coin.

- Staking: The practice of temporarily locking away some of your crypto in exchange for a regular return, much like interest in a savings account. You cannot stake Bitcoin, but you can stake Ethereum and some other cryptocurrencies.

What is web3?

You might have heard a lot of buzz about web3, but just what the heck is it?

The original World Wide Web (WWW) was based on open protocols and a decentralized client/server architecture. Individuals hosted their own websites, and those websites were largely non-interactive.

Web 2.0 saw the dawn of centralized services like Facebook, Netflix, Reddit, Twitter, and YouTube that allowed dynamic content and greater two-way interaction. But over time, dozens of services were boiled down to just a handful that effectively control the internet. And since a handful of companies and content creators make all the money, much of the internet has been flooded with garbage written by the lowest bidders.

web3 promises to fix this by moving web services to a blockchain. In theory, services will be dynamic as they were in Web 2.0 but also decentralized as in the original WWW. It’ll also make it easier for content creators to get paid.

A very simple way to imagine web3 as an arcade machine, where you dump in quarters to experience content. The other end of that is people are sending you quarters to view your content. Everyone pays and everyone gets paid. But that content is in a blockchain and immutable, so if someone doesn’t like your content, like the CEO of Twitter, they can’t just ban you and delete your content (that they were profiting from anyway).

One of the big promises of web3 is digital ownership. If you find a rare sword in a video game, it stays with that game. But, in theory, that sword could be an NFT that you actually own and can transfer to other video games.

However, the current realities are pretty unappetizing:

- Most web3 content is in the form of NFTs, which are for the most part a digital certificate of ownership for digital pictures. Storing data in the blockchain is currently extremely expensive, so the NFT is merely a pointer to an image on a regular web server.

- Bitcoin isn’t programmable like Ethereum is, so much of web3 is currently built on Ethereum. Ethereum transactions cost a variable amount of Ethereum to process, called gas, and those gas fees can be absurd. Imagine paying $5 to fill out a web3 form but $100 to pay for the gas to process the transaction.

- Much of web3 is already centralized into a few key services, like OpenSea, which defeats the purpose of web3.

web3 offers a lot of promise, but there isn’t much for users yet. And there may never be. Moxie Marlinspike, former CEO of encrypted messaging app Signal, has written a comprehensive critique of web3 after experimenting with it as a developer.

Crypto wallets and basic crypto security

The term “wallet” is a bit of a misnomer since all cryptocurrencies are stored on their respective blockchains. A wallet is more like a digital key used to access your coins on a blockchain.

A common refrain is “not your keys, not your coins.” When you store your coins on an exchange like Coinbase, the coins are effectively not in your control. It’s strongly recommended to store your coins in a wallet that you own. Much of this wisdom comes from the sudden shutdown of the early crypto exchange Mt. Gox, in which the company took off with the Bitcoin stored on their exchange.

Things are a bit different now. Reputable exchanges like Coinbase are regulated and insured, so it’s highly unlikely that they’ll shut down and lock you out of your coins. But a cyberattack or other unforeseen event could be a possibility. Exchange and brokerages can also sometimes halt trading at the worst times. Many stock brokerages ceased trading of Gamestop stock in 2021 to stop a short squeeze.

In general, it’s a good idea to store your crypto in your own wallet. The only downsides are that you are responsible for securing your wallets and there is a cost associated with sending crypto from one address to another (eg. “gas” for Ethereum.)

There are three types of wallets:

- Paper wallet: This is an older style of wallet where your encryption key is printed on a piece of paper, often with a QR code. They’re largely not used these days.

- Cold wallet: A wallet that isn’t connected to the internet. This could be an old laptop or a specialized hardware wallet like a Trezor or a Ledger Nano. You connect one of those devices to a desktop computer whenever you want to access your coins.

- Hot wallet: A wallet connected to the internet, like a wallet app on your phone such as Exodus Wallet.

It may be helpful to think of a hot wallet like a checking account, in which money is more accessible but easier to steal and a cold wallet like a savings account where the money is harder to access and harder to steal. It’s a good practice to keep a little crypto in a hot wallet for convenience and the bulk of it in a cold wallet.

When choosing a wallet, make sure it supports the currencies you want to store. For instance, the Coldcard is a popular wallet amongst Bitcoin maximalists, but it can’t store any other cryptocurrencies.

When you set up a wallet, you’re given a list of 12 or 24 words that together are like a password you can use to recover the wallet in case you lose access to it. That word list is called a seed phrase. Because anyone with that phrase can create a copy of your wallet, and you can’t restore your wallet if you lose that phrase, the seed phrase is just as important, or even more so, than the wallet itself.

You need to write down at least two copies of that phrase and store them in secure locations. Many people opt to store their seed phrases on metal cards (confusingly, often called wallets) by either etching or stamping the words on the metal. There are also metal cards with metal letter tiles that you can assemble like a Scrabble board, such as the Keystone Tablet Plus. It’s also a good idea to memorize the phrase if you can.

Also, when you buy the hardware wallet (like a Trezor), buy it directly from the manufacturer instead of a third-party seller like Amazon or eBay. Scammers sometimes intercept hardware wallet packages, set them up with a seed phrase, put a card in the box with the recovery phrase, and then put them back on the shelf. An unsuspecting customer sets up the wallet with that phrase and the scammer later copies the wallet elsewhere and takes all the money.

If you buy a hardware wallet and it includes a seed phrase in the box, send it back. Do not use it!

Some other crypto security tips:

- Do not plug a hardware wallet into a computer you do not control. Many malwares now specifically target cryptocurrency.

- Create long, random passwords for your crypto accounts. Store them in a password vault like 1Password. Also, take advantage of two-factor authentication.

- Security is a must on whatever computer you do crypto business on. Linux and macOS machines are generally much more secure than Windows. If you want to go the extra mile, you could only connect your hardware wallet to a computer running Tails, a super-secure version of Linux that runs from a USB thumb drive and clears personal information every time you shut it down.

- When sending crypto, be sure to always send it to the correct address. Most wallets have a button to automatically and accurately copy addresses.

- Many hardware wallets let you create multiple software wallets for each currency. For instance, you could create one Ethereum address to spend and interact with web3 dApps, one address to store Ethereum you don’t want to spend, and a third to store Chainlink, which is a token that lives on the Ethereum blockchain.

How to spend Bitcoin

There aren’t many people or businesses who accept Bitcoin natively. But there are a number of services that either let you instantly convert Bitcoin to USD through a debit card or let you quickly and cheaply swap between Bitcoin and USD.

Many companies offer Bitcoin debit cards. You deposit Bitcoin to a wallet that’s tied to the card. When you use the debit card, the Bitcoin is automatically converted to USD to fund the transaction. Examples are Bitpay and Coinbase Card.

LVL is a new and popular app that combines a crypto exchange with a bank and supports Bitcoin, Ethereum, and Litecoin. You can buy crypto through LVL or transfer it to your account, sell it, and have the cash automatically deposited into a checking account. You can then use the LVL debit card to spend the cash.

Cash App lets you trade Bitcoin in the app and offers a debit card to spend your fiat.

Strike is a popular service that lets you have your paycheck directly deposited into Bitcoin. It lets you quickly and cheaply convert between BTC and USD and transfer the funds to a bank account. The company will soon offer a debit card.

Other cards like Fold, don’t let you directly spend Bitcoin, but offer Bitcoin cashback rewards when you use the card.

Services like LVL and Strike have sparked a GetOnZero movement, which encourages people to store all of their wealth in Bitcoin in order to stick it to the banks and financial system. A common strategy is to pay for everything with a credit card, and then cash out enough Bitcoin every month to pay the credit card bill. Proponents argue that doing things this way helps you accumulate more Bitcoin and thus make more money over time.

Note that any time you convert Bitcoin to USD that is a taxable event. If you make all of your purchases by converting BTC to USD, that might become a huge headache at tax time. On the upside, if you buy BTC when it’s high and spend it when it’s low, you might be able to write off the losses and reduce your tax burden.

Learn more

We covered the basic concepts, but there’s much more to it if you’re interested in digging.

Cryptozombies: What is blockchain — a cartoon-based lesson using zombies to explain the concepts.

The Ultimate Guide To Understanding The Basics of Blockchain and Cryptocurrencies.

Intro guide to Ethereum by Coinbase — in our opinion, Ethereum will be the long-term winner in this space.

List of the top beginner articles by a Silicon Valley venture capital firm.