What shortages/price hikes are you all anticipating?

I feel like I’ve seen a lot of news about higher fuel prices and an expectation that wheat will be in short supply and higher in price, but I was reading this article and found that Russia is one of the leading exporters of fertilizer. Fertilizer shortages could ultimately really impact agricultural yields globally. What shortages/price hikes are you all anticipating and prepping for?

-

Comments (23)

-

JennyWren - April 2, 2022

Since Christmas I have been keeping a weather eye on prices in my shopping basket and shortages.

Vegetable and Sunflower oil availability has been hit and miss and price had gone up by 10pin the same time.

Tinned meat has gone up 30p and I have started to see a rise in fresh meat and vegetable prices.

I mentioned in an earlier thread that Growmore fertiliser has almost doubled in price since last season and other fertilisers have also seen a scary price increase.

The UK is more or less self sufficient in flour, but I don’t think that won’t stop some corporate chancer selling this commodity on the world market to make a quick buck.

It’s feed wheat we import so I’m expecting meat and dairy prices to rise as farmers pass on the costs, but I have a feeling there will be a number of farms that skip breeding cycles to try and mitigate costs.

Obviously energy bills are rising and I think we are not done with that yet.

High energy and fuel prices and fertiliser costs and scarcity are going to affect how farms are going to move forward with crop choice and set aside.

I think whatever means you use to heat your home, in the coming months it is going to get more expensive.

Maybe we need a frugal thread…..

-

brekke - April 3, 2022

I like the idea of a frugal thread! I found freeze dried banana #10 cans on Amazon the other day for $10. My kids love these so I bought a couple. They are a few weeks out on shipping, but I at least have the sale price locked in. I’m always on the hunt for deals and would be happy to share my finds. We have a worldwide group here, so we would probably need to add geographic reference for pricing as I’m sure it’s different depending on where you live.

-

TheFuries - April 6, 2022

Is there a brand you recommend of bananas? My toddler demands them daily when he’s picky and I will be in deep trouble without them. I want to store banana as a comfort/high energy food item. I hate having to buy 5 brands (they’re expensive) only to learn they don’t taste good. Many thanks in advance!

-

brekke - April 6, 2022

My son loves the Brothers freeze dried fruit brand. He also just tried the Great Value freeze dried strawberries & bananas and liked them too. I’m hoping he likes the Augason Farms ones, but they won’t arrive until May.

-

TheFuries - April 7, 2022

Thanks so much! I’ll look into both and see if I can get him to like one should we not be able to get fresh bananas.

-

brekke - April 7, 2022

You’re welcome! I just discovered that the Augason Farms bananas are dehydrated/dried and not freeze dried, so I’m not sure my kids will like them. I wish they sold sampler packs! Lol. Oh well. I’ll open a can this summer and let them try them before I buy any more.

-

-

Bill Masen - April 2, 2022

Heating Oil, Automotive products, Pharma products, Diesel, Petrol, LPG, Propane, Butane, plastics, Rubber , nylon, polymers, paints, FERTILISERS, eggs, Chicken, Beef, Pork, Lamb, Wheat, Barley, Oats , metals, ammunition, plastics etc ALL going up in price.

Many food stuffs getting more difficult to source including Free Range eggs, fresh fruit, China is currently hoarding half the worlds grains.

-

Bill Masen - April 2, 2022

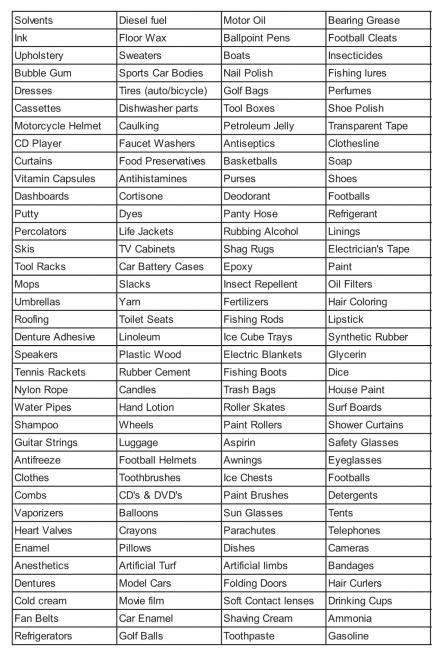

FYI products madfe from oil, ALL going up in price

-

Pops - April 2, 2022

Russia is a typical 19th century colonial, extractive economy. They export oil and gas and believe they’ve seen their peak. Nitrogen fertilizer is made with natural gas. P & K are ores mined and refined. That they are going for a last expansion should not have been a surprise.

There are so many kinks in the supply lines now it is scary and feels to me like a spinning top that has slowed to the point of instability.

I ordered 150# of wheat berries from Azure and received zip. Azure ships bulk and prepared food to local drops around the country monthly. The local coordinator told me quite a few people who had ordered grain were disappointed. This is non-GMO, certified organic but still I’ve not been stood up on such a basic item before. I’m well stocked for just us for many months but a few extra loaves for the neighbors would be nice.

The drought in the US midwest and west continues and could affect the next grain harvest even if the Ukraine situation suddenly resolves—figure about this july (when last harvest runs out) all the way to next summer/fall when the next harvest comes in. Beef prices may perhaps moderate a bit locally because pastures in the western half of the country are in bad shape and growers will be culling herds—but the prices will rise later. So of course will all meat and dairy, not to mention the chicken cull from bird flu…

By choice at my house we aren’t as susceptible to energy price spikes as most people, I’ve worked from home for almost 30 years and we don’t drive many miles. In 2015 the US began exporting fracked oil and oilmen’s deep pockets will keep shelling out political money to keep those taps open. Oil is the master resource and the strength of the US is tied in large part to extracted fossils. The current blip in light “tight” oil is but the last gasp, financed by ever-depleting, old fashioned “loose” oil. There is still spare production capacity globally but as we’ve seen, in the global casino that is commodity pricing, even the hint of shortage costs each of us dearly.

In my opinion, this decade is the window of opportunity to transition to a lower energy state. Prices for wind, PV and batteries have been steadily falling and are now at par with fossils in many instances, I’m putting together a system for about $1/watt. The thing is, and I’m not sure of the exact reasons, but even though finished equipment prices are as low as they’ve been, availability of components is spotty and intermittent. That may resolve any second now— or, with increasing demand straining basic raw materials supply and shipping glitches increasing … and fuels shortages perhaps increasing as well… it may get worse.

At the local big box store they now lock up rolls of copper wire by running a thick cable through the spools. Prices are at least double and empty shelves common. And we haven’t even begun to electrify.

Realize that the existing system runs on fossils, and every alternative energy scheme is based, at its most fundamental level, on the existing fossil fueled infrastructure. That infrastructure is so ubiquitous as to be invisible to us. We think about it as much as a fish thinks about water, i.e.: we don’t. To wait until actual fossil shortage to transition will be like waiting for the tornado to hit your house before you head for the shelter, you’ll be halfway to Oz before you get to the door.

And speaking of oil, russia just banned export of sunflower oil, which is about 8-10% of global edible oils and they produce three quarters.

Oh, and the central banks that have been spinning the top faster and faster these last 15 years with the zero interest and unlimited asset purchasing that has pumped stock markets to the stratosphere are starting to raise interest rates to fight inflation. Mortgage interest jumped by a third overnight. As per the norm, there will ensue a housing price collapse and recession… at least a recession. Sell your imaginary bitcoin while there is still a bigger sucker, lol.

Lots of worrying news, it ain’t armageddon, but it is at least interesting.

Keep calm and plant potatoes ;^)https://www.agweb.com/markets/pro-farmer-analysis/pro-farmer-evening-report-march-31-2022

-

Bill Masen - April 2, 2022

Fertiliser prices in the Uk jumped from approx £250 a ton to nearly £1000 a ton in recent weeks, Fertiliser is made from Natural gas and its prices have gone insane. PLUS Trade embargos on Russia also means the west cannot buy Fertiliser from russia any more.

As reported in other threads, many farmers are stopping production of Chickens, eggs, fruit etc in the UK because of energy and fertiliser and fuel prices

GLOBAL food shortages are happening now (A) the Ukraniane war ( wheat, oil, gas, fertiliser, minerals and metals. (B) Climate issues in the Western US caused by DROUGHTS ( grains, Legumes, Beef, Pork, Chicken, fruits, bread) (C) China has been stockpiling grain for over a year, they make up 12% of the worlds population but they have hoarded 54% of all Wheat and rice.

Places like Sri Lanka as the global crisis means the whole country cannot afford fuel or food.

-

atlanticrando - April 2, 2022

It’s a difficult one to prepare for, but it seems to chip shortage will continue to be with us for quite some time. Aside from the consumer electronics side of things, it has continued to throw the car market totally out of whack.

Aside from the strain and distortions COVID put on the system, there’s some vulnerability in that apparently Ukraine produced about half the world’s neon, needed for chip production.

-

JennyWren - April 3, 2022

Sunflower oil: UK bottler has a few weeks worth left.

Looks like it’s happening sooner rather than later.

‘The biggest cooking oil bottler for UK shops has said it only has a few weeks’ supply of sunflower oil left.

Ukraine and Russia produce most of the world’s sunflower oil and the war is disrupting exports, said Edible Oils.

The company, which packages oil for 75% of the UK retail market, is ramping up supplies of other oils for shoppers.

Meanwhile, manufacturers of foods that contain sunflower oil, like crisps, oven chips and cereal bars, are reworking their recipes.‘ -

brekke - April 3, 2022

I’ve already noticed our grocery bill increasing significantly. And gas is downright unaffordable. We’ve been a single income family for the last five years and doing quite well, but now our savings are depleted now and my husband will have to return to work when our youngest enters school this fall. It was always “the plan” that he would so we could rebuild savings and increase retirement funds, but now it’s a need and we’re having to cut back on non-essentials and road trips to visit family.

-

Greg P - April 4, 2022

It looks like the extended drought will have major impact on Arizona & California’s agriculture sector. A brief look at the crops they grow leads me to believe that a salad is going to become way more expensive and/or difficult to obtain. In addition, California is a major producer of fruits and veggies, along with one of my favorite nuts – almonds.

In the long run ( 5-10 years – my guess) beef will become prohibitively expensive. It has long been a very inefficient way to produce protein. The amount of water (1800 gallons?) that it takes to produce a pound of beef vs. plant protein ( about 90% less) is simply unsustainable.

-

Momof6 - April 5, 2022

Quarterly I go with a friend who has a vendors listened to a restaurant supply store, not Sams or Gordon’s, but the kind where the guys walking around shopping are wearing their chef’s whites. Anyway, I thought you might find prices and shortages interesting. Obviously not a comprehensive list but what I noticed or bought

#10 cans of fruit and vegetables up 50% from $6 something to $9 something a can

#10 cans of beans up $1 from $5ish to $6ish

dried beans and rice only being sold in 50 pound bags or larger, no 25 lb bags

Paper plates up from $28 dollars for 1200 to $34

All frozen seafood up several dollars no matter size or kind

Veggie burgers up from $80 for 100 to $104

Cheese up less than $1 per 5 lbs. Absolutely no sour cream in any size or brand and they usually have it even in 5 gallon buckets too, but none at all

Chicken quarters $.99 lb, wings $1.99 lb but at least they had some, last two times I went they didn’t have any, legs/thighs $2.99 lb, boneless breasts $3.99 lb, no bone in breasts. These prices are a huge mark up. I regularly bought boneless breasts for $1.59 lb

Pork loin had only gone up 30 cents to $1.69 lb

Goat was up $10 a side

There was no salad, usually they sold huge bags of various chopped salads, you could only find the ingredients to make salads sold whole.

this is obviously not a comprehensive list as I didn’t check beef prices or frozen meat prices, just kind of ran off a few observations and our receipts. This was in southern Ohio

-

TheFuries - April 6, 2022

In addition to everyone’s feedback:

Orange and citrus juices will skyrocket soon. It’s already gone up several dollars from two years ago in FL. For some time know, Florida has dealt with citrus greening, which is ruining crops. They’re unable to deeply mitigate the situation, so the University of Florida and others are working on creating hybrid trees, among other solutions. It appears to be affecting limes and lemons as well, but oj is more intensive to grow. We also had a hard frost recently, which will effect yields this spring. Big Citrus is collapsing in both FL and CA.

Almonds. Very water intensive crop and California, where most grow in the US, is reeling from another historic drought.

Vanilla beans. The price spiked a year and a half ago, by a lot, but the growing situation in Madagascar isn’t improving.

-

Greg P - April 8, 2022

Thanks for the heads up on the orange situation. That’s the beauty of a site like this where you have people from all over the country/world. There has been no news coverage here in Indiana ( no surprise) of what is happening in Florida. I’m sure once orange juice, etc. prices spike, then there will be coverage. (The proverbial horse will be waaaay down the road by then – LOL). In this state we grow a lot of corn & soybeans, some hog farming as well. Have to keep an eye on the weather & hope for the best for crops this year.

-

-

Pops - April 8, 2022

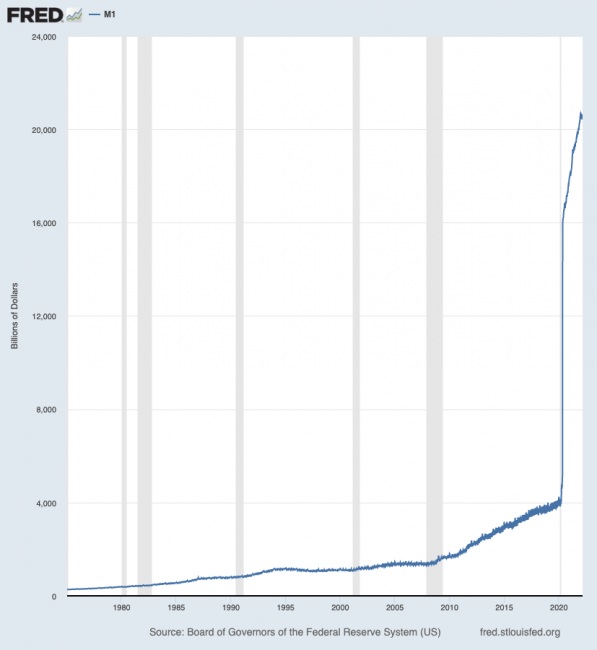

Seems to me the next shortage will be in pay envelopes. Increasing the US fed prime rate is the panic button pushed when the bubble grows out of control. We’ve been blowing this bubble for quite some time—and we went to warp speed in 2020. This is the “M1” money supply; cash, checking and liquid savings:

That right there is the cause of inflation. When you inject that much free money into the economy, it just knows. And every profit-centered entity automatically goes into suction mode. Of course what the Fed magically giveth, it now taketh away. When it does, all the growth and prosperity and dreamy economy that was artificially induced turns back into a pumpkin.

In addition and just off the cuff, we have an energy crisis in every flavor of fossil, it might be a bigger problem than the 1970s embargoes (OPEC won’t/can’t save us this time either). 7 of the 9 times oil has jumped like it’s done recently we’ve had recession. Of course China is again shutdown from COVID; Not to mention an almost certain housing market crash is brewing (after historically long free credit binge)—after a mere ¼ pt prime rate increase mortgage rates have gone from less than 3% to over 5%. Combine that with stupendous price inflation and affordability will crumble.

Oh, and Europe is careening toward World War Last… interesting times indeed.

My point is this, I am thinking about both sides of the ledger, not just inflation but recession and income loss. The inevitable end of the radically free money of the last 2 years, on top of the loose monetary props of the previous 12 years is pretty scary in scope. Things that can’t continue usually don’t and it seems to me we’re about a Wile E. Coyote length past the edge of can’t.

If a person develops a side hustle unrelated to their main income they are miles ahead when the economy goes south. I’m a print graphics designer but I’m also remodeler and I even do outside ranch/dairy work. Think about your income like you think about your preps: 2=1 & 1=0

The opposite side of the coin is expenses. We don’t have any debt, for which I’m eternally thankful. That would be (and was long ago) my first priority. I’m trying to reduce our outlays; utilities, media, subscriptions, etc and upping the savings at the same time. I’ve been working on a PV system piecemeal (finding lots of supply snags) to cut down exposure to electricity rate hikes. I’ve spent lots of time and effort on air sealing and insulation upgrades to this old house. If we stay at this location, which looks increasingly likely, I’ll investigate adding a heat pump to the existing nat. gas heat system but not until I can get tighter.

Garden.

So much of the time prepper boards are about lists of stuff to buy. Prepping for recession is kind of the opposite. It’s about getting small, striving for resilience and economy.

-

Bill Masen - April 8, 2022

Hard to remain apolitical on this issue, prolly best I dont say much, but your current goverment first said inflation would not happen, then they said it would only be a little rise, they they said it would be very brief, then they tried to blame the previous government. But the fact remains those who dumped trillions of dollars into the US economy have caused this crisis. I only hope they have a way out of this, perhaps with infrastructure investment and cutting any reliance on any imported essentials.

-

atlanticrando - April 8, 2022

Certainly agree to disagree with you and Bill on some things, but even those of us who are quite sympathetic to MMT would agree that the stimulus packages weren’t exactly executed in the best way. Quite the opposite in a few cases…

In terms of government action, no matter where anyone is on the political spectrum, it’s important to note that a big driver of inflation has been pandemic profiteering and governments should be stepping in. There have been a few (imperfect, grain of salt) new studies here in Canada that point to the corporate side. One calculated that over a quarter of inflation was profit-driven, and another pointed out an all-time low in corporate taxation and how much increased sales were driven by widening costs and margins, rather than passing down supplier costs. One can look at the incredible consolidation in certain industries like meatpacking and really see the confluence of a lot of issues that The Prepared‘s readers are concerned about–food security, supply chain logistics, COVID-19 (some of these behemoths treated their workers terribly and had massive outbreaks), and now inflation from profiteering.

Pops, your last point about focusing on savings rather than acquisitions is really good and often underappreciated. As someone who has been getting more interested in preparedness over the course of the pandemic, the gear mongering and tool reviews, etc. are certainly a lot more ‘fun’ than focusing on the fundamentals of sound personal finance, etc.

-

Sun Yeti - April 18, 2022

I’m not saying inflation won’t be a problem, but it should be noted that the fed changed the way they calculated M1 in May of 2020, so that spike is an artifact; there weren’t 12 trillion new dollars injected into the economy all of the sudden. It’s a weird way of doing a graph, I don’t know why they didn’t just recalculate the pre May 2020 supply according to the new metric so you could compare apples to apples.

-

Pops - April 18, 2022

You’re right, they changed savings to M1 that were M2, so all the increase in that chart wasn’t helicopter money. My bad for using the long time scale.

But almost half was. What they did was buy up paper and reduce rates to .25% allowing banks to make more loans; and they sent out stimulus using borrowed money.

From WaPo:

“The Fed’s broadest measure of the money supply, called M2, is more than $21.6 trillion today, up from $15.5 trillion in February 2020.

To ease credit during the pandemic, the central bank helped increase the money supply by buying nearly $5 trillion in mortgage-backed and government securities. The Treasury Department pitched in by borrowing trillions more to send stimulus checks to most Americans.” WaPoFed Balance sheet 3/20 = $4.3tr

Fed Balance sheet 3/22 = $8.95tr

About $4.6tr in “easing” alone.

StatistaOf course that isn’t new, they’ve been doing it since the recession, that’s where the 4.3 tr came from, and it isn’t actually “money” either, just 1s & 0s. Investopedia

Point is, they’ve been borrowing trillions to float an economy that hasn’t wanted to float for a dozen years:

US GDP has grown is around $6tr since 2010.

US public debt in that period, even before the pandemic in 2019 US debt was up $8tr StatistaThe economy grew $6tr and public debt grew $8tr—not even a 1 for 1 return… and that doesn’t count private debt.

-

-

Pops - April 26, 2022

I think I complained about Azure in this thread so I’ll complement them now.

After trying for 3 months for a little bump to my long term grain storage from Azure Standard I finally got 100# of wheat and 50# of corn to ship. Their supply has been good they say, just high demand.

Just transfer in mylar bags with O2 absorber and stick in a metal garbage can, or plastic buckets and you have a great basic ration to get you through a few months.

Azure is a great resource, organic, non-gmo if that is your thing, staple/fresh/frozen you name it. But for me it is mainly the bulk grain delivered cheaply at a good price. Price is up on the next batch, currently Red Wheat berries are 81¢/lb in 50# sacks and they have 880 sacks coming in on the 29th.

Check out their site (I’m not affiliated). Ordering is online with a monthly cut off date for your area. Then they load up what they have of what you ordered (not always everything ships) then they send via their own trucks all over the US. You just meet the truck at a prearranged spot and a local “coordinator” organizes the other local customers into an unloading and sorting squad. Then the truck proceeds to the next stop and you load up your stuff and go.

I’ve been very happy recommending them for years. Here is how they work

-

- Neutrality for the sake of survival and how to manage the full spectrum of ideologies - 20 hours ago

- Essential medical reference books for the prepper library - 23 hours ago

- News for the week of 2024-07-22 - 23 hours ago

- AR15 stock weight - 4 days ago

- Burning Candles - 5 days ago

This forum is heavily moderated to keep things valuable to as many people as possible. Full community policies are here. The basics:

- 1. Be nice to each other.

- 2. Stay focused on prepping.

- 3. Avoid politics, religion, and other arguments.

- 4. No unfounded conspiracies, fake news, etc.

- 5. Debate ideas, not people.