Prepping for economic collapse

What does economic collapse mean to you?

To me, economic collapse isn’t the stock exchange disaster of the 1930’s. It is the slow decay and crumbling of our independence and self-sufficiency.

I used to move money. It could be a fifty-dollar transaction bound for Vietnam or a boat in Indonesia or a fifty million settlement heading to another bank. It was a very high stress position with zero margin for error.

There was a bank of clocks on the wall that represented cities like San Francisco, Toronto, Montreal, London, Paris and New York, who were all part of a routing system to move money globally. The clocks acted as a reminder of international cut off times for payment traffic.

I processed telexed and trader payments that landed in my in basket, took payments from branches and other banks over the phone, and ensured that what I processed was delivered correctly and on time.

This involved a series of intricate fail safes and verifications. It was an area of banking that was a target for fraud and required high degrees of vigilance.

I used to wake up with nightmares from the stress of my job. The first thing I did when I left that job was to take off the watch I wore as part of the time critical component of my work. To this day, I don’t wear a watch.

My time in that position came on the heels of three years spent in the letters of credit department. The orders were shipped to other countries because of their less expensive labor costs.

The point of telling you about this experience as the lead in for prepping for economic collapse is simple. Everything money related is moving around you all the time, quietly in the background. Deals are made. Money is bought and sold. Trade happens.

Meanwhile, you go to work, earn a pay check and live your life. You spend money and contribute to the trade and commerce around you. If you save money your bank gets the use of your money and pays interest to you for that use.

Everything is interconnected now because of trade and international lending. This is not a case of you have something and I have something and let’s trade. It is a case of competition, trade quotas and trade sanctions, and of maintaining a complex balance.

International trade is not symbiotic, meaning that the relationship is not mutually beneficial.

We trade now because we have to do it. We are not sustainable. We gutted our jobs in North America.

My Dad and I used to spend hours in debate and discourse. This subject was one of them.

Dad’s position was that we had priced ourselves out of the labor market due to unions and that manufacturers went for the cheap labor elsewhere.

My position was that our labor costs were being undercut by countries with an entirely different standard and cost of living. How were we ever going to compete with that?

The end result is that container after container of manufacturing equipment, some hundreds of years old and highly specialized were disassembled, and shipped elsewhere, and our jobs left with it.

The finished product was shipped back to the company who then sold it to us at the same price as if it had been made here. It was a version of enterprise that destroyed jobs, manufacturing and charged us more to shop while they did it.

I remember some companies hung on as did some consumers who refused to buy anything not “made in Canada” or “made in the USA.” Now, those labels are deceptive because they aren’t entirely made in either country. Parts come from elsewhere or something is partially assembled elsewhere.

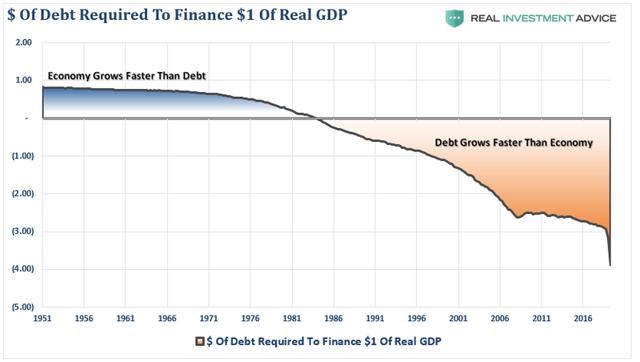

Which brings me to economic collapse. Have any of you ever wondered about how easily this whole thing could go off the rails? I do and probably not for the reasons that other people do. I don’t get caught up in economic jargon or theory. It’s simple and straightforward.

I look at our countries as preppers who were capable of self-sufficiency. We joined with a group of other prepper countries to trade and barter. We made a bad choice and put ourselves in a bad position.

We can’t make the items we used to make and are now dependent upon other countries for items we need. We are no longer self-sufficient.

If there is a disaster in the other preppers’ country or we have a dispute with the other preppers or one of their friends’ countries, then we get cut off from the items we need.

That doesn’t sound like solid preparedness to me.

Our goods used to be closer to home.

To make our arrangement work, we need to ship goods over long and sometimes difficult routes. The grounded container ship in the Suez Canal was a good example of how easily the arrangement can grind to a halt.

The current pandemic could easily run us aground in a different way. We have no idea when this pandemic will be over or if it will ever be over. The mutations carry the possibility of antibody resistance which is a big concern.

India is being overwhelmed by the pandemic. They, like China, may have a huge population, but their workers dying or unable to work will impact their production.

We also can’t forget the long term effects of Covid-19 upon people who survive it. Some are dead six months later. Others are left with permanent lung or other debilitation.

I can’t change history. I have no control over other people. What I can do is adjust how I prepare in the face of the potential for economic collapse.

I have started researching which items such as medicines are made in other countries. I am also researching which items are made entirely in North America and making a list of suppliers and manufacturers.

Part of my search is for local and regional suppliers because in an economic collapse, shipping long distances may not be viable. It is also a way to foster mutually beneficial relationships for long term survival.

I am making a list for stocking more of certain items that could be impossible to get if a supplier country halts or reduces production.

I am also looking at what skills or items I could make if necessary and getting the knowledge or instructions hard copied and in place now.

What do you think economic collapse will look like? What are you doing to prepare for it?

-

Comments (19)

-