Get free weekly credit reports – prevent identity theft and fraud

One of the good things to happen from Covid is the ability to request a copy of your credit report for free weekly. This used to be reserved to one free report a year from each of the three main credit bureaus.

Is this an issue?

Yes. With social distancing and lock downs this past year, banks and other financial institutions have expanded the ability to apply for credit remotely. This is great to prevent the spread of the virus, but makes things easier for the bad guy to open a new line of credit under your name. The bad guy can pretend to be you over phone, email, or the internet and using readily available information about you, that can be bought online for as little as a dollar, they can open up a new bank account, credit card, or take out a loan.

Why you should check your credit report

If someone has opened up a line of credit under your name, or even your child’s name, the sooner you move and report it, the easier it is to fix. If you don’t catch this, it can harm your credit score and prevent you from getting a credit card, car loan, or even a mortgage when you need it.

How do I check my credit report?

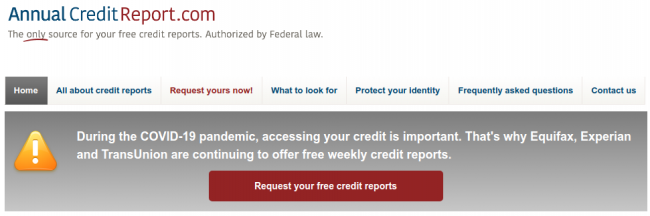

ONLY go to https://www.annualcreditreport.com. This is the only authorized and official way to access your credit report. Other may charge a fee or give you a partial summary of your credit report. Once you pull up your credit report, print it off or save it as a PDF on your computer. Once you exit that window, you lose access to that report until next week, then you have to request it again. I like to save them so I can refer back to them in the future if I need to, or know when the last time I checked my report was.

What do I look for on my credit report?

Look through your entire report and see if it is accurate. Do you always pay your bills on time but see that there is a late payment in November on your credit card? You need to look into that and try and fix that as that is hurting your credit score.

Look for any names or addresses on the report that you don’t recognize.

You’ll see a section listed as soft/hard inquiries or soft/hard pulls. Soft pulls are done for marketing purposes and even though it feels like an invasion of your privacy, it isn’t harming your credit and probably isn’t fraud. This is done all the time by banks and other organizations that sell your data and send you credit card and loan offers. Your current bank will also do the occasional soft pull to then see if they should offer you a higher limit on your credit card in hopes that you will spend more.

Hard inquiries are when you open a new line of credit such as a new bank account, loan, or increase your credit card limit. These will affect your credit score for a time (so don’t do a bunch within a short amount of time if possible) and this is an additional place where you look for fraud. Do you see a hard pull from a bank in another state that you don’t recognize? Probably fraud.

What do I do if I see something on my credit report?

Check the credit reports with the other two credit bureaus and see if it shows up on there as well. Sometimes it won’t. Contact the institution that the line of credit was opened under. For example, if you see that a credit card was opened up at Discover two months ago, but you don’t have a Discover card and you certainly haven’t gotten a credit card in the past year, then contact the fraud department at Discover. Tell them that you were checking your credit report, you see that a card was opened up in your name, and it was not you. You will then have to prove you are who you are, and they will do an investigation. Before you hang up, write down as much information about the call as you can. Who did you talk to, what did they say they will do, when/will they get back to you, do you have a case number, and any other information you can think of that would be valuable for a smoother follow-up. Also, tell them to contact the credit bureau and have them remove the information from your credit report.

Go to the credit bureaus that you have noticed the fraud under and report it to them as well. Check your credit report again after you think it has all been resolved to make sure it was properly removed from your credit report.

What can I do to prepare or be proactive against this form of attack?

Go to the three credit bureaus, Transunion, Experian, and Equifax and request a credit freeze. This will lock down your account and not allow anyone to open a new line of credit unless you contact the bureaus and ask for a temporary unfreeze of your credit so you can then go apply for a line of credit.

How this relates to prepping

I feel that good security of your finances is critical to prepping. If you don’t have money because some scumbag stole it all or ruined your credit, then you can’t buy your preps right? Just how we secure our homes against home invaders, we need to have good operational security (OPSEC) of our finances too and make sure we fix any break-ins there as well.

Have you ever found fraud on your credit report? Do you check your credit report regularly? What other steps or tricks do you use to protect your finances?

Any other questions you have? Hopefully I can answer them.

-

Comments (2)

-