As if you needed another reason to always have a go-bag constantly at the ready, a new NOAA report brings word that 2020 has already hit the previous annual record of 16 disasters that cost $1 billion or more — and there’s still a whole quarter left to go.

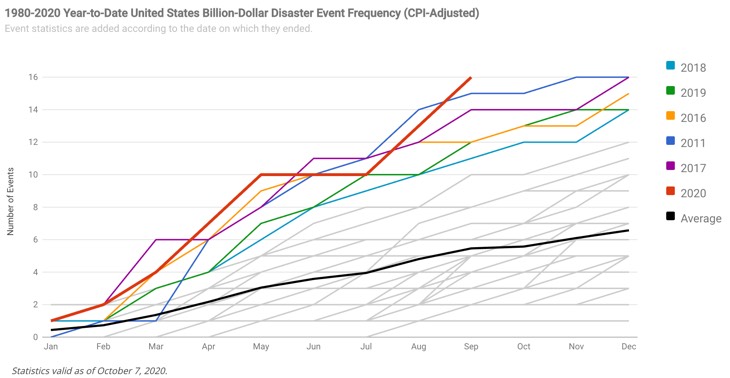

In 2020 (as of October 7), there have been 16 weather/climate disaster events with losses exceeding $1 billion each to affect the United States… The first 9 months of 2020 ties the annual record of 16 events that occurred in 2011 and 2017. 2020 is the sixth consecutive year (2015-2020) in which 10 or more billion-dollar weather and climate disaster events have impacted the United States. Over the last 41 years (1980-2020), the years with 10 or more separate billion-dollar disaster events include 1998, 2008, 2011-2012, and 2015-2020.

Not only is 2020 a terrible year for climate-related disasters, but the frequency and intensity of these events is accelerating. The chart below shows just how bad 2020 is, outstripping 2011 and 2017 in terms of major catastrophes of all types.

Note that this report doesn’t include Hurricane Delta, which is poised to break two records of its own. When Delta became a named storm, it was the earliest annual 25th named storm in history; and when it makes landfall on Friday, it’ll be the first time in recorded history that ten named storms have made landfall in one season.

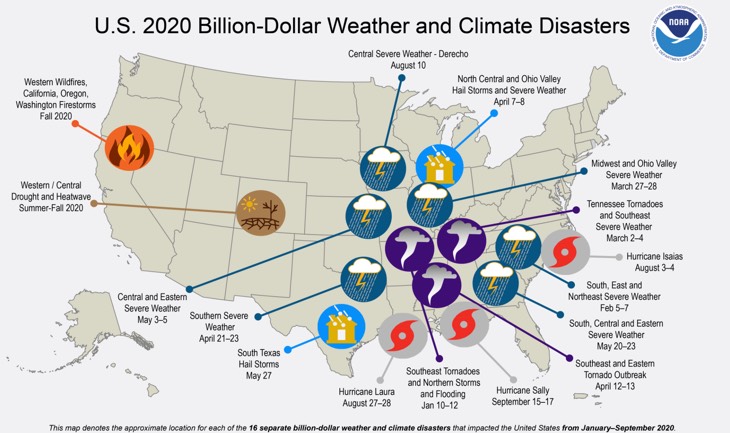

The map raises some prepping questions

As I look at the map associated with this report, a few preparedness-related questions come to mind:

James Wesley Rawles was probably right to identify Montana and the surrounding states as The American Redoubt — a safe place for preppers and survivalists to relocate to. I wonder how much the region’s relative immunity to climate catastrophe has something to do with the insane real estate market in Bozeman, MO — 0 percent vacancy rate, with most houses attracting about six bids.

What I really, really want to know is how insurers are going to handle not just the losses but the rates and pricing. I’m from the Louisiana Gulf Coast, and anecdotally home insurance has been going up. I know people in my network who’ve been priced out already and are just going without home insurance despite the onslaught of hurricanes in the region. So in areas that keep getting hammered by different types of catastrophes, how will people continue to afford to insure their homes?

If insuring your dwelling gets too expensive, then does it make sense to rent instead of own? Also, what happens to the universe of financial products that are tied to the American mortgage — the bedrock of so many investment-grade assets?

What questions does this report raise for you? Do these climate change patterns affect your life plans?

You are reporting the comment """ by on